Tech News

Salary sacrifice cuts – who stands to gain?

We all know the draw of a successful employee benefits package, and how valuable they can be in attracting and retaining important talent. But is this about to change?

Salary sacrifice schemes as we know them may soon be a thing of the past thanks to new Government plans to get rid of tax advantages.

In a matter of months, those employee benefits’ that have long been used as an added incentive for enticing staff, could suddenly lose their appeal – and it’s likely that the majority of employer benefits packages will be affected.

All change for employee benefits

Denounced as “unfair” to all tax payers – and more importantly, too costly to the Government – salary sacrifice schemes are all set to change come April 2017.

The Chancellor’s announcement of the removal of 99% of employee benefits from the tax advantage, will affect those salary sacrifice schemes that have traditionally proved popular as tax saving incentives, including gym memberships and company cars (unless they have ultra low-emissions).

For anyone newly joining a salary sacrifice scheme in April, the income tax advantages relating to certain employee benefits will end. From then on, employers can still offer salary sacrifice schemes to their employees but the tax incentives will no longer apply.

It’s poised to have a significant impact for employers – taking the “incentive” out of tax incentive schemes, packages will suffer without the appeal of tax-free benefits previously used as leverage to attract and secure the highest-performing individuals.

The benefits of Tech – how does it work?

How will the new changes impact TechBenefits? The truth is, not a lot.

Not all salary sacrifice schemes work the same way; TechBenefits is designed as a National Insurance savings scheme, rather than a tax incentive so it won’t be affected by the new Government changes to employee benefits.

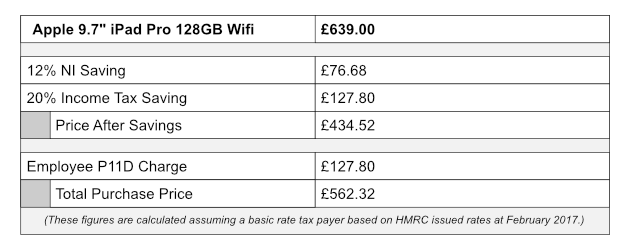

When your employees buy the latest technology products through TechBenefits, they’ll pay 20% income tax on the value of the product when declared on a P11D.

As a result, unlike other benefits such as mobile phone contracts, they won’t be subject to the removal of any tax advantage…however they will still gain from as much as a 12% saving on National Insurance Contributions:

With imminent changes set to disrupt how employee benefits’ work for employers and employees alike, the focus more than ever before will be on delivering a package that your workforce actually want to receive.

By providing every employee with access to the latest state-of-the-art technology, including those that wouldn’t otherwise be able to afford it, you could gain from a more motivated, more engaged, and more technically proficient workforce; and because TechBenefits will be unaffected by the impending salary sacrifice cuts, your employee benefits incentive will remain just as strong.

– Mark Hooper

Managing Director